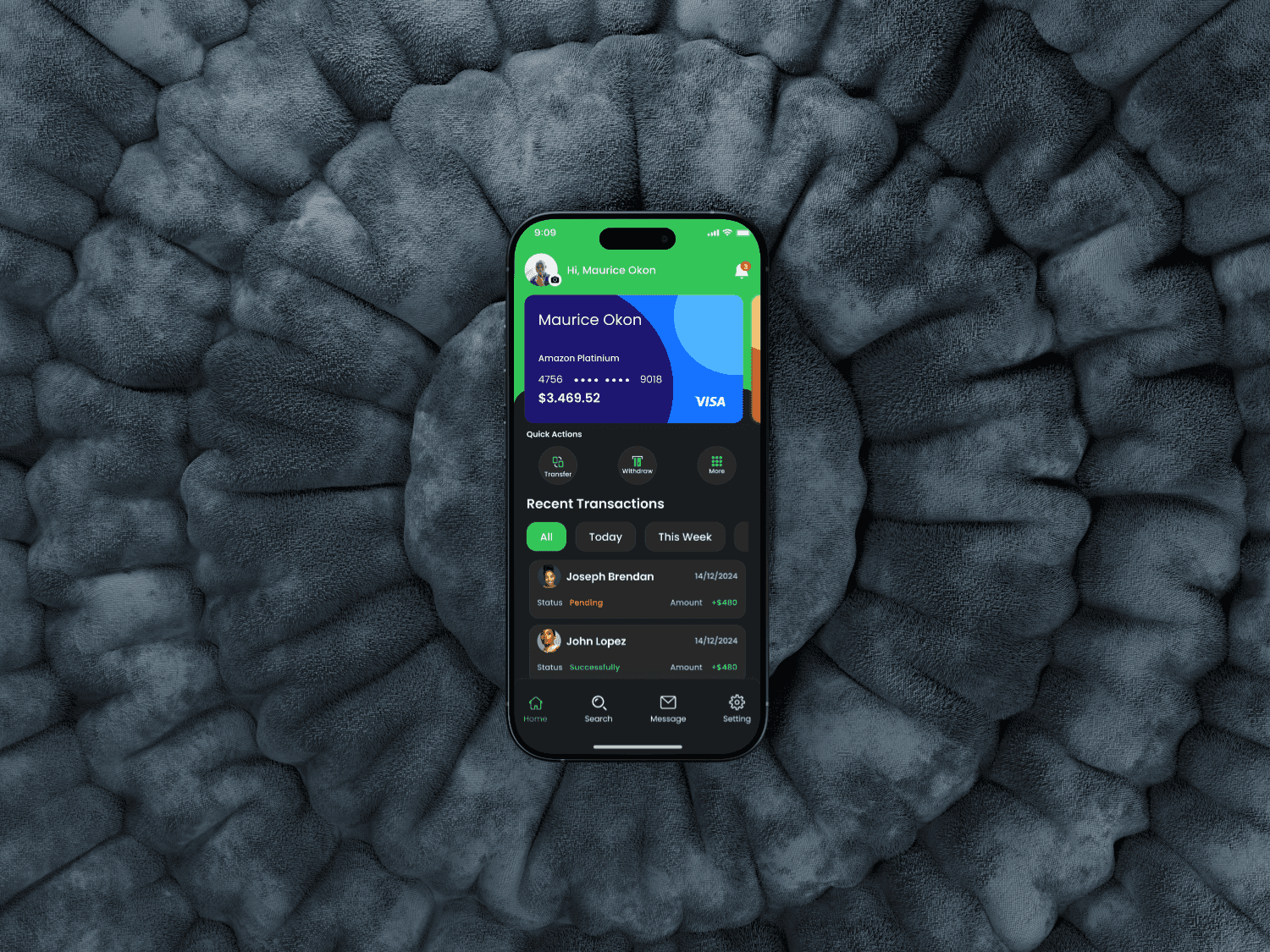

Project Title

A mobile finance app that allows users to send, receive, and manage money securely.

Guilder Pay

2024

Personal Story

My journey with Guilder Pay began as a thrilling challenge—one that promised to push the boundaries of my skills and creativity as a UX/UI designer. The objective was clear: design a seamless mobile payment app that would make sending, receiving, and managing money not just simple, but delightful.

Problem Statement

Users struggle with complex UIs, slow transaction times, limited wallet features, and security concerns in existing payment apps. The goal is to create an intuitive, fast, and secure mobile payment app that addresses these pain points and enhances user experience.

My Process

User Interviews

Demographics: 20 participants, aged 18-45, varied financial backgrounds.

Conducted one-on-one interviews and surveys to gather qualitative and quantitative data on user experiences and preferences.

Key Pain Points

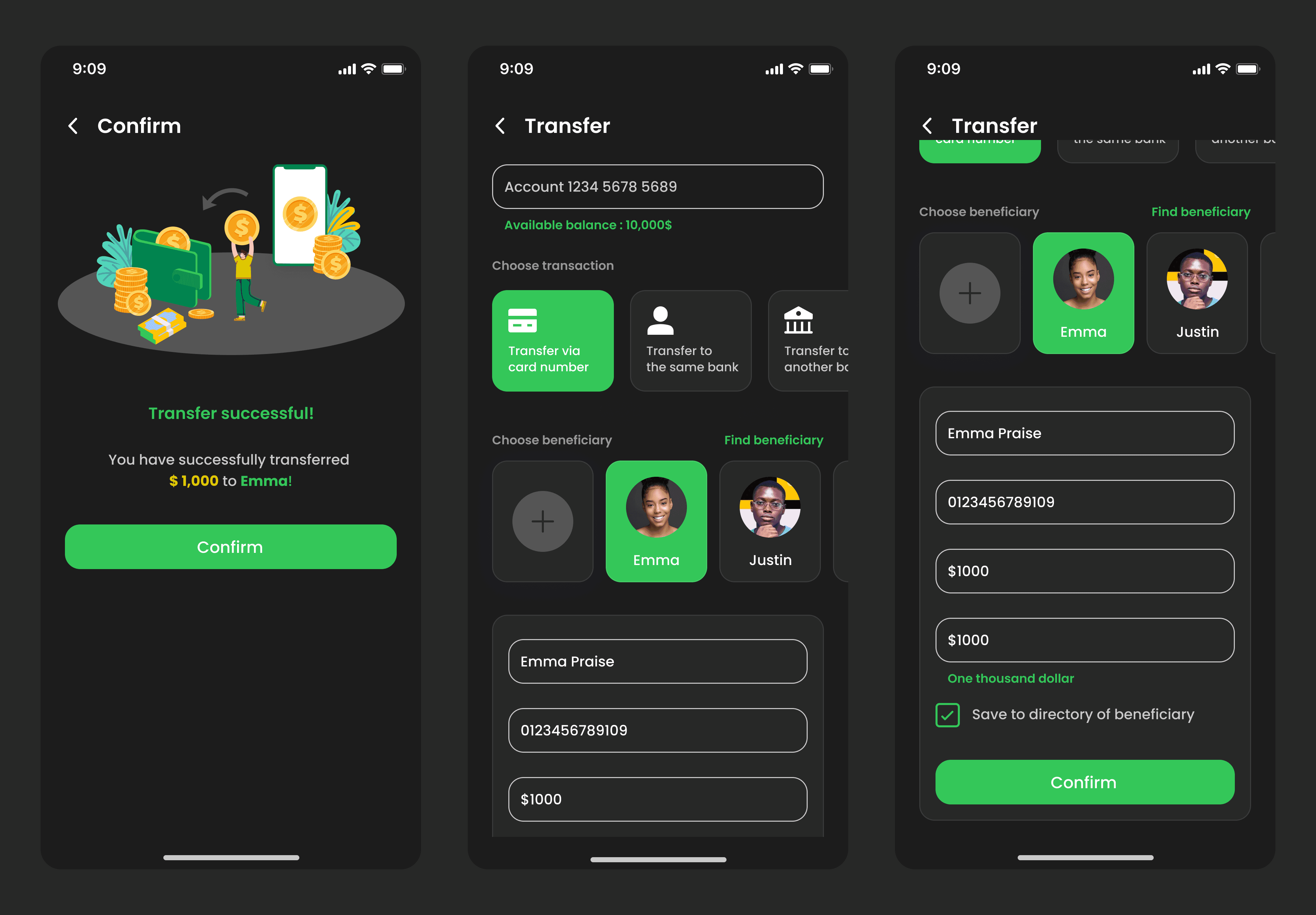

Fast & Simple Transfers: Users wanted one-tap money transfers without multiple confirmation screens.

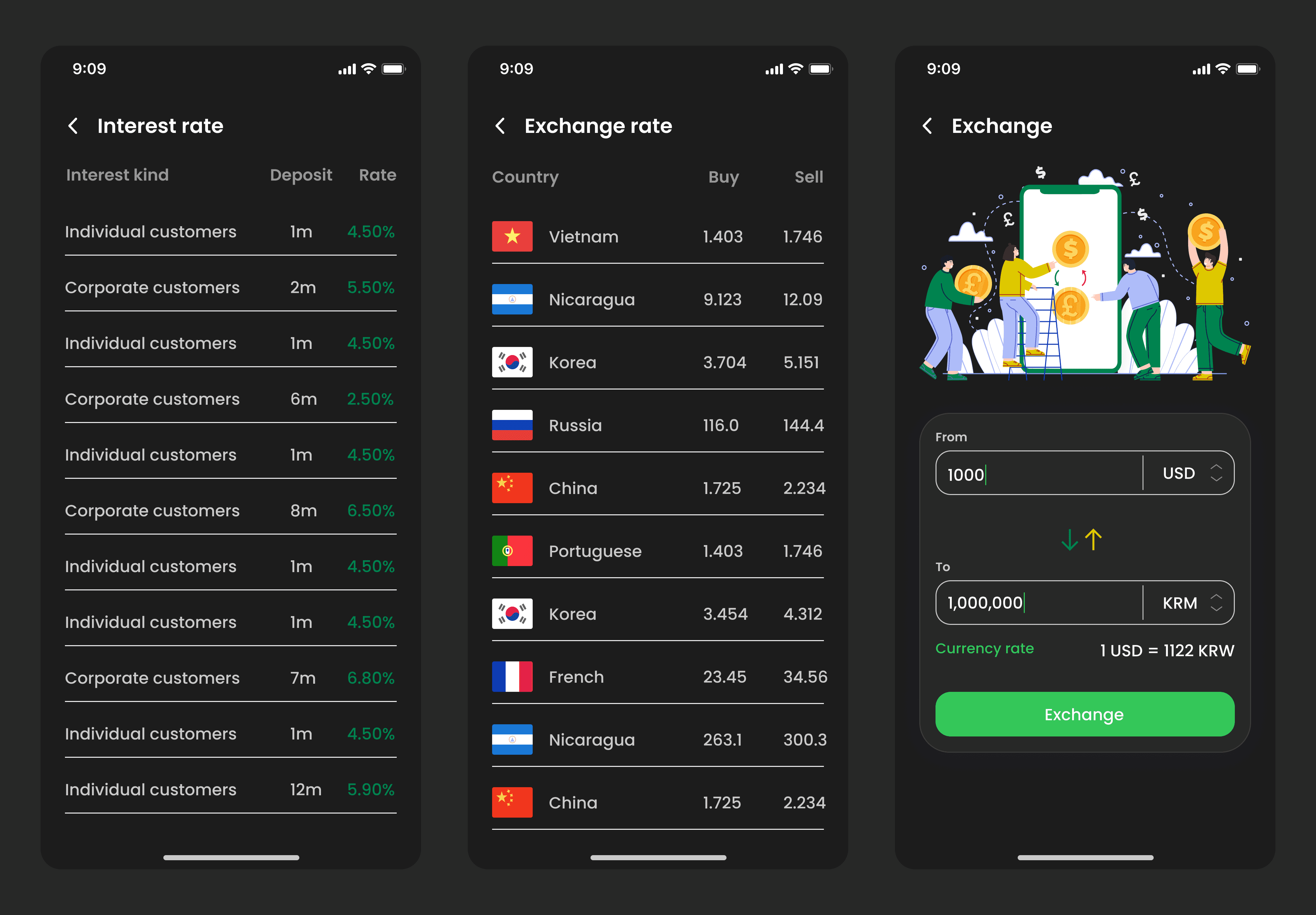

Transparent Fees: Unclear transaction fees led to frustration with competitors.

Multi-Functionality: Users preferred an all-in-one app for transfers, bill payments, and savings.

Security First: Biometric authentication (fingerprint/Face ID) was a must-have feature.

User Preferences

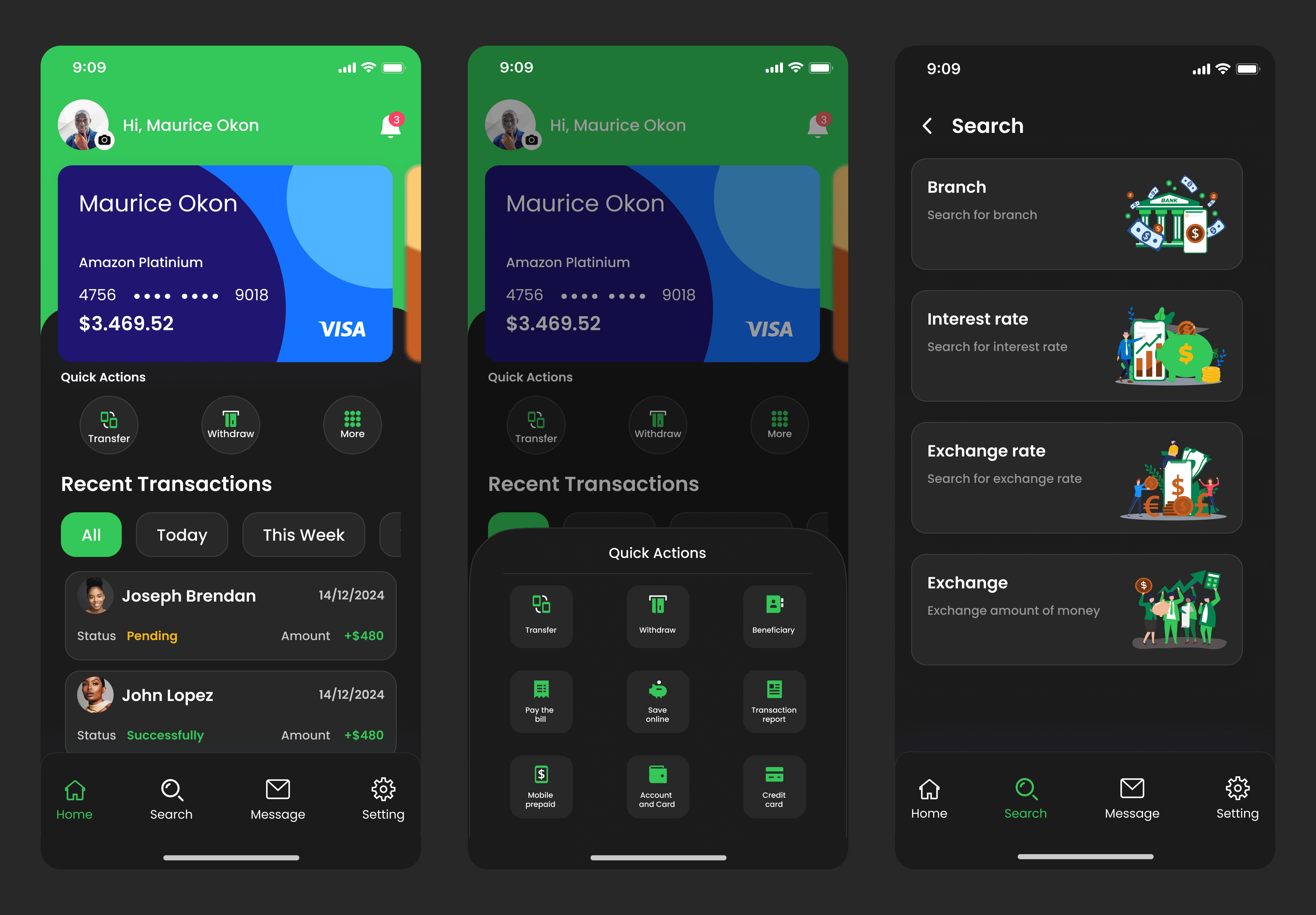

Ease of Use: Emphasis on intuitive navigation and minimalistic design.

Real-Time Updates: Desire for instant notifications and real-time transaction updates.

Personalized Experience: Interest in personalized financial insights and recommendations.

Digging Deeper: Competitor analysis

Competitors Analyzed: Chime, Venmo, CashApp

Key Insights

Complex UI in Existing Apps: Users found leading payment apps cluttered and difficult to navigate.

Slow Transactions: Many competitors had delayed processing times for transfers.

Limited Wallet Features: Few apps integrated savings, budgeting, or bill payment features effectively.

Security Concerns: Users lacked confidence in existing platforms due to fraud risks.

Ideation and Design

Brainstormed design solutions with a focus on simplicity, speed, and security.

Developed initial wireframes and low-fidelity prototypes to visualize key features and flows.

User Testing

Created high-fidelity prototypes using Figma and conducted usability testing with target users.

Gathered feedback on usability, aesthetics, and functionality to refine the design.

Final Results & Key Features

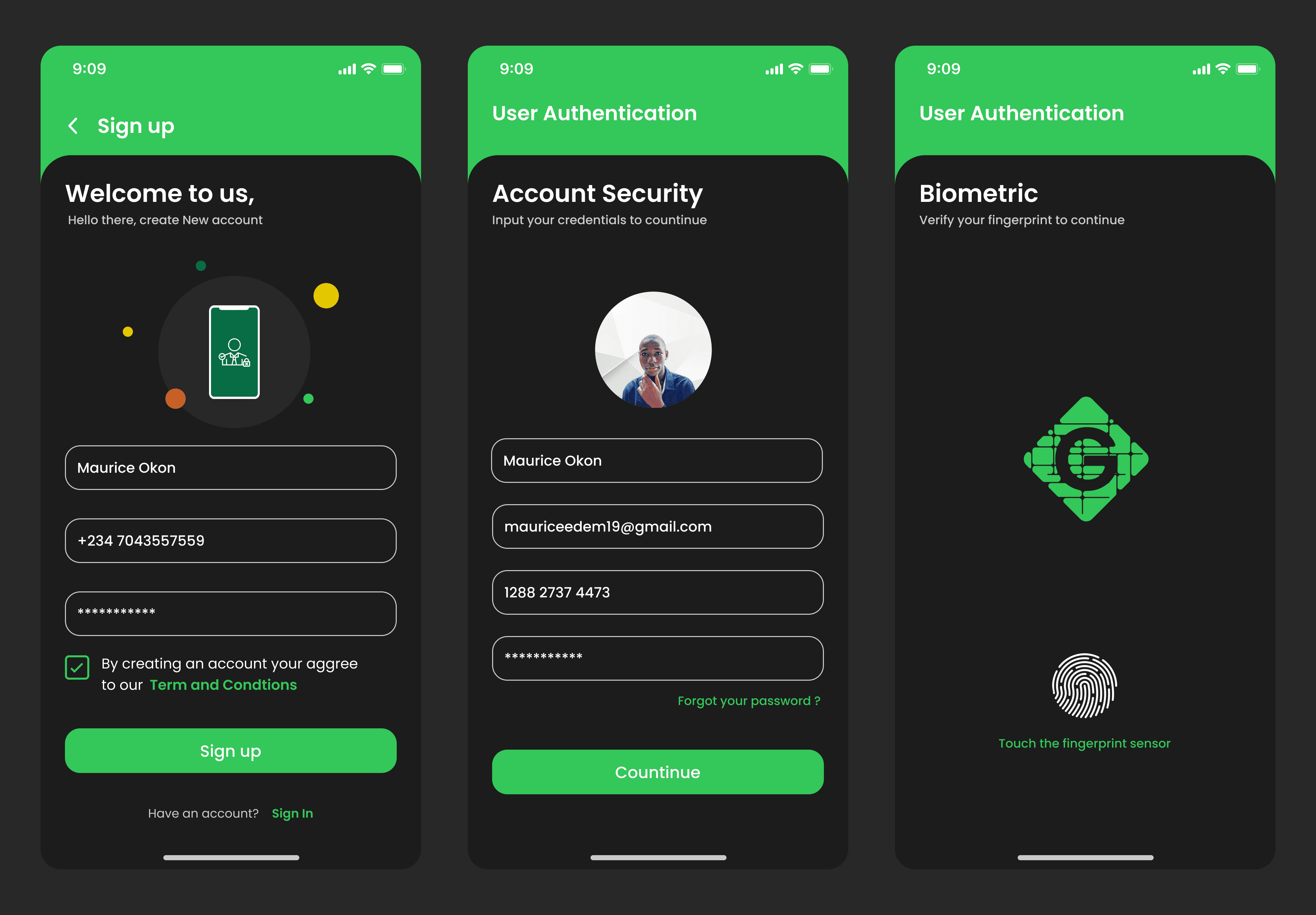

Streamlined Onboarding – Easy & Quick Access

One-minute sign-up with auto-verification.

Biometric authentication for secure logins.

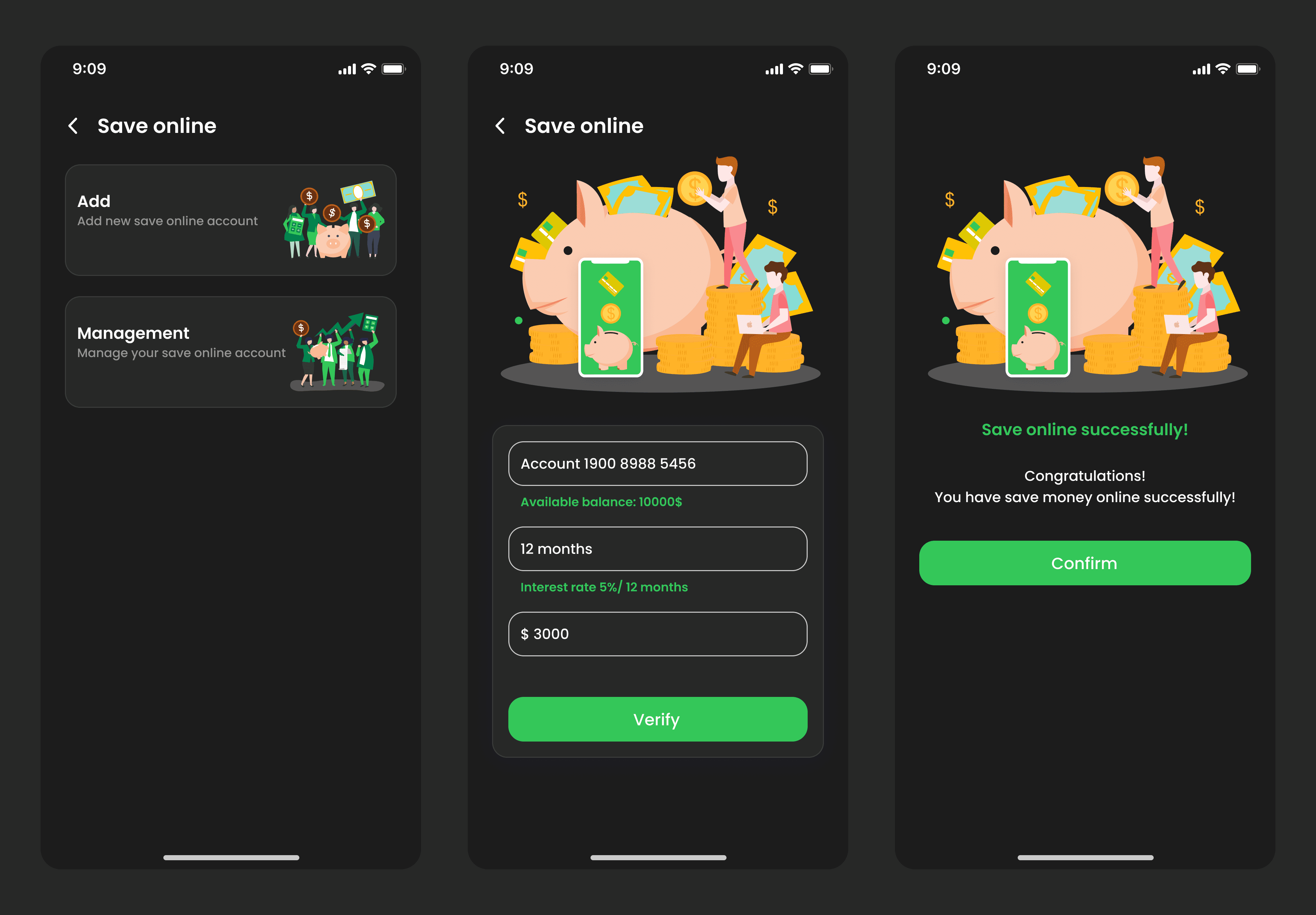

Smart Wallet – More Than Just Payments

Instant money transfers with real-time processing.

Auto-budgeting tool to track expenses.

Savings vault with interest-based returns.

Expense categorization and visual analytics for better financial management.

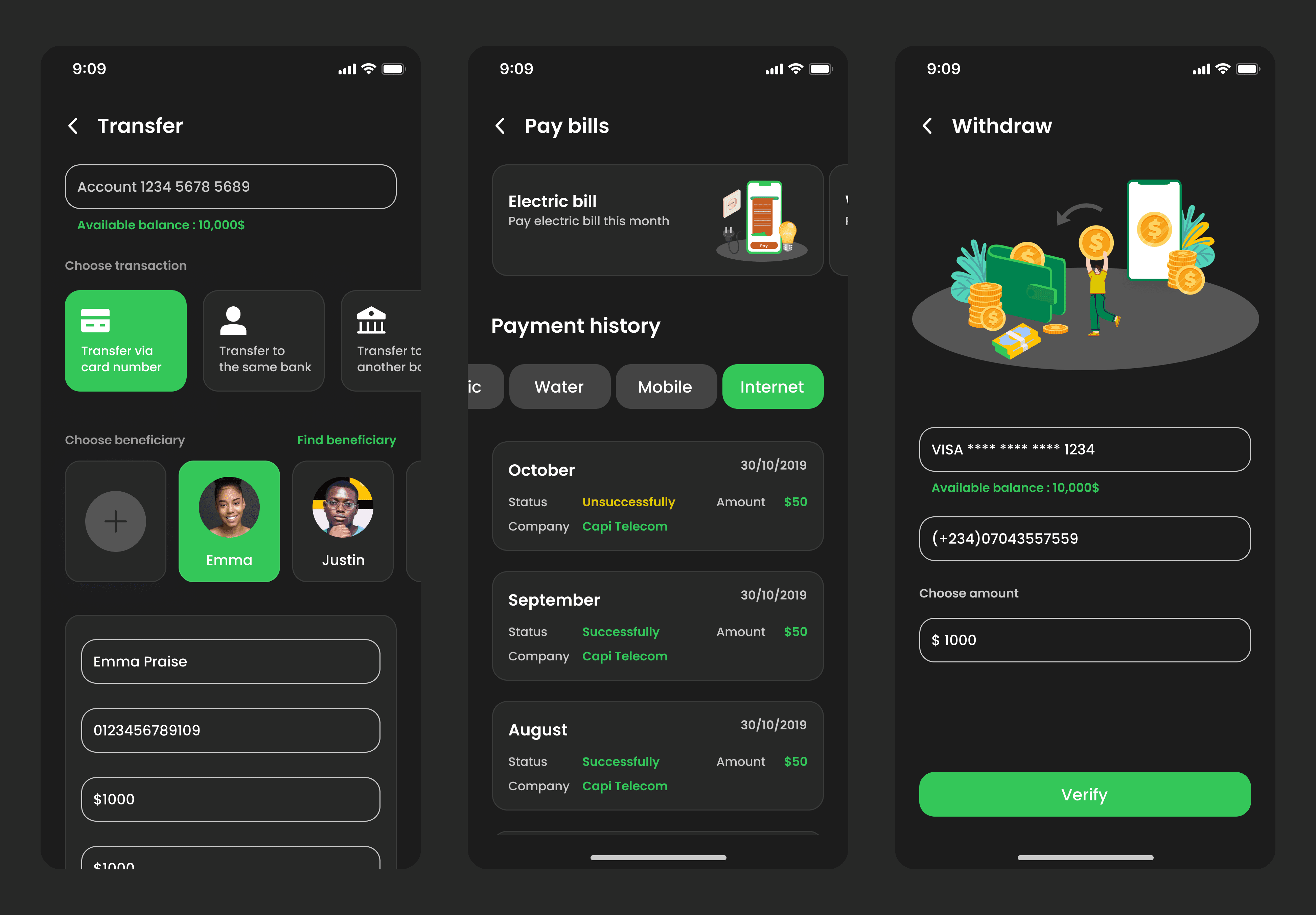

Transparent Transactions – No Hidden Fees

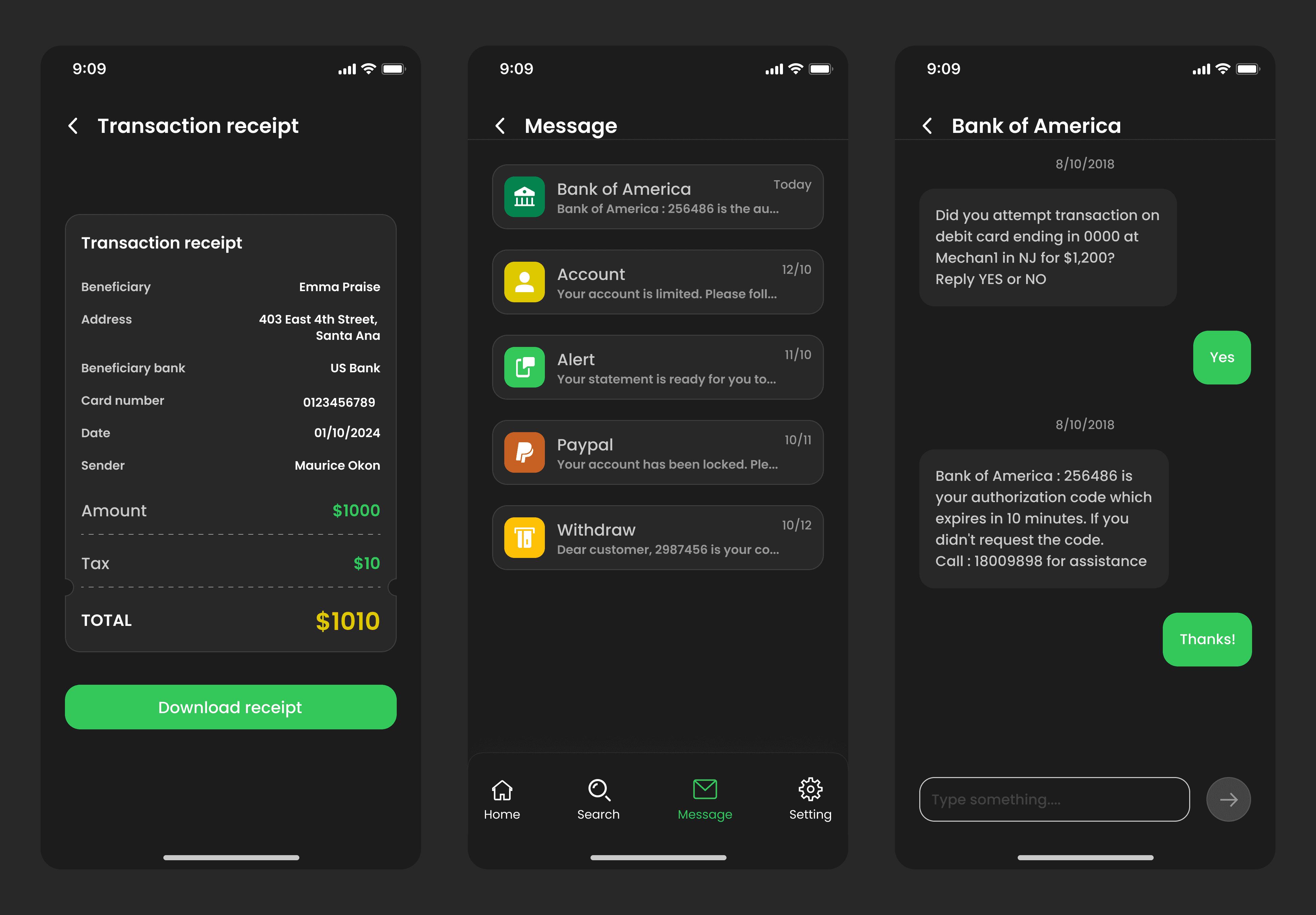

Clear fee breakdown before sending money.

Instant notifications for every transaction.

Monthly statements with detailed transaction history.

Bill Payments & Subscription Management

One-click bill payments for utilities, internet, and TV.

Auto-subscription tracking to avoid overdrafts.

Customizable payment reminders and alerts.

Designing for Scalability

Reflecting on The Impact

40% Faster Transactions: Optimized processing speed reduced wait times.

+70% User Retention: Simplified UI and smart wallet features kept users engaged.

+50% Security Confidence: More users enabled biometric authentication compared to competitors.

+60% User Satisfaction: Positive feedback on the app's usability and feature set.

30% Increase in Monthly Active Users: Engaging features and improved user experience drove higher usage.

Lessons Learned

Key Takeaways

This project highlighted the importance of a user-centric approach in fintech. By addressing real user frustrations and incorporating robust security measures, Guilder Pay became a competitive solution in the mobile payments industry. The comprehensive design process, from research to implementation, ensured a seamless and secure user experience, significantly enhancing user satisfaction and trust.

THANK YOU SO MUCH!!